The surplus of CORSIA-eligible carbon credits is expected to become negative by 2030 in the absence of new supplies coming online, according to Abatable analysis. Alejandro Limón Portillo and Greg Lydka Morris outline the findings and explain what’s next for the CORSIA scheme after its bumpy start.

The aviation sector contributes around 3% to global emissions today. As a hard-to-abate sector, direct low-carbon technological solutions including the development of sustainable aviation fuel (SAF) and electrification are being developed to reduce this impact, but they will take time to proliferate due to current cost and technological barriers.

In the interim, to address emissions the International Civil Aviation Organization (ICAO) in 2016 adopted the Carbon Offsetting and Reduction Scheme for International Aviation, or CORSIA, to address the projected growth of the sector’s emissions from a 2019 baseline. Under the scheme, any growth in aviation emissions from 85% of 2019 levels needs to be mitigated.

CORSIA officially entered its first phase in January this year following a pilot period from 2021 to 2023. Phase 1, which only applies to states that have volunteered to take part, runs from 2024 to 2026, with the mandatory Phase 2 of the scheme starting in 2027. To comply with CORSIA, airlines can purchase SAF, increase fleet efficiency, or purchase CORSIA-eligible carbon credits.

However, it’s been a turbulent start.

In March, the significant carbon credit issuers Verra, Gold Standard, and Climate Action Reserve (CAR) remained only conditionally approved by ICAO’s Technical Advisory Body for use under the scheme. This will be re-reviewed in September this year following a re-submission process that was completed at the end of April 2024.

This means CORSIA Phase 1 currently has only two eligible standards through which credits can be acquired – American Carbon Registry (ACR) and ART TREES. On top of this, given the requirement for CORSIA credits to attain Letters of Authorisation (see below) from host countries, the mechanism’s supply remains significantly limited.

Currently, only one recent issuance of 7.1mn Guyana ART credits can be used for the scheme, and the ICAO Technical Advisory Body decision indicates this may remain the case for the rest of 2024.

Demand to outstrip supply by 2030

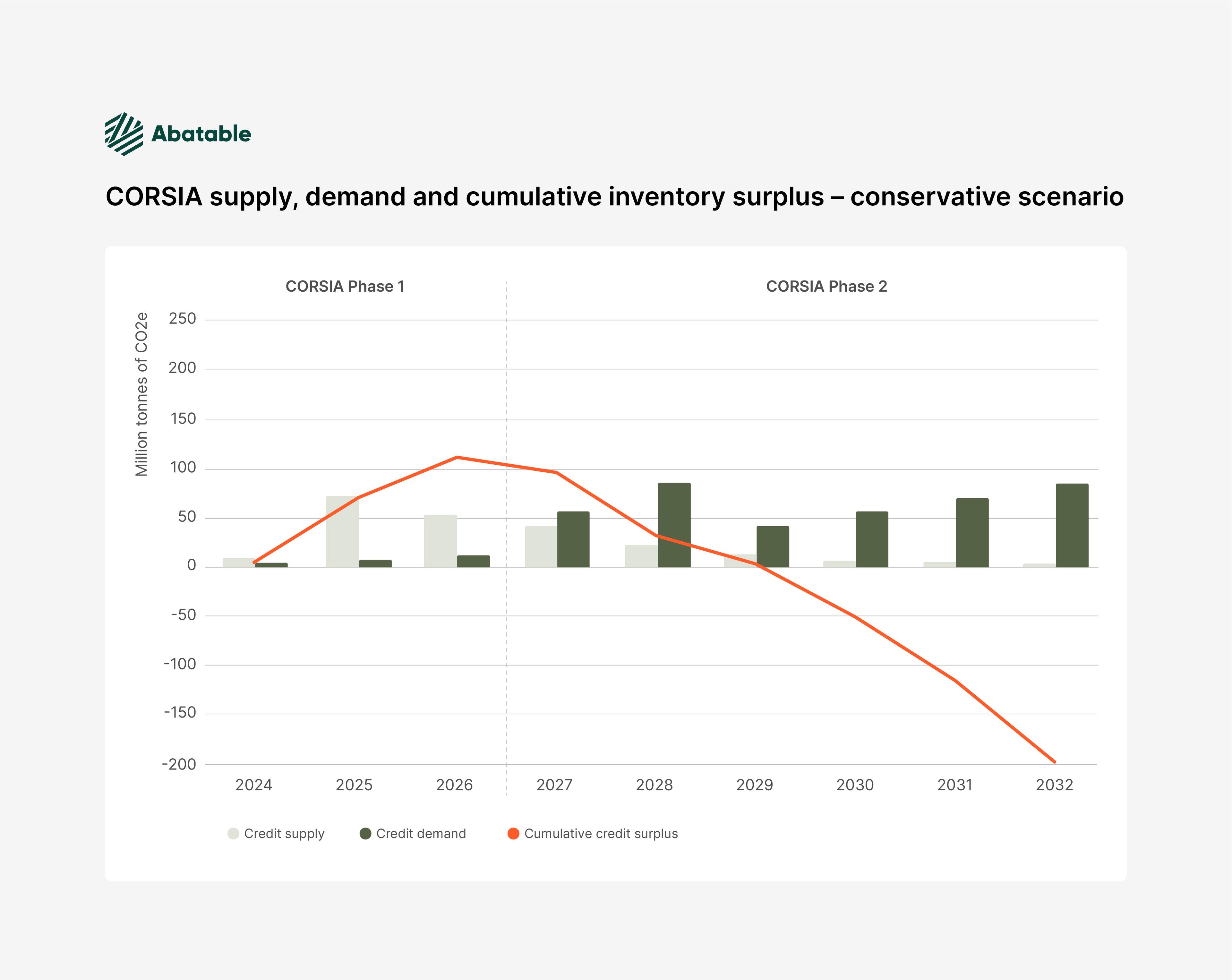

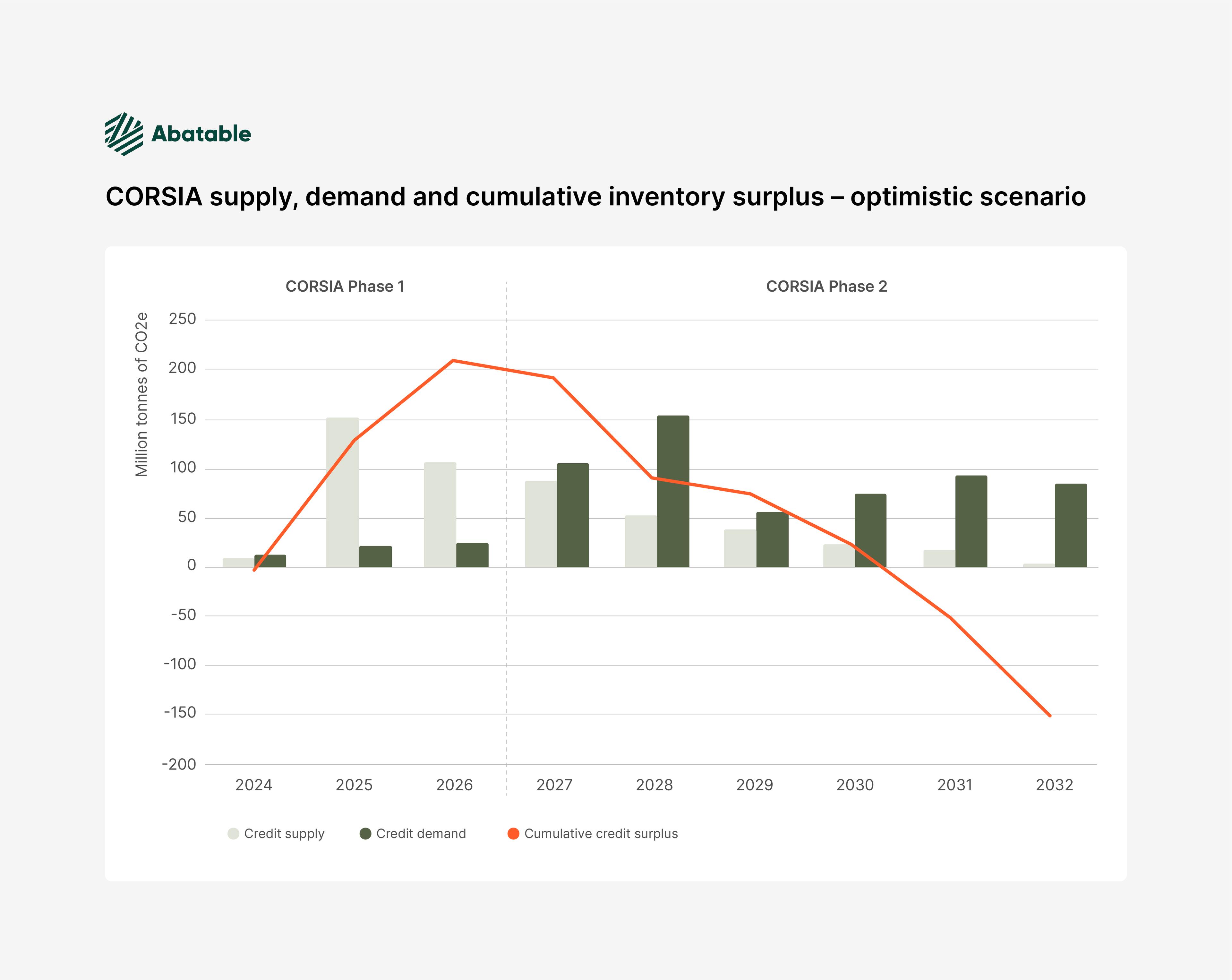

Under current market conditions, and in the absence of new credit supplies coming online, Abatable’s analysis indicates that demand for CORSIA credits will outstrip supply in Phase 2 of the scheme somewhere between 2029 and 2030.

Under a conservative scenario modelled by Abatable, CORSIA demand does not surpass 100mn credits until after 2034, however the supply of CORSIA-eligible credits peaks in 2025 and the cumulative supply is only able to meet demand until 2029 (see Figure 1).

Without new projects emerging to generate credits, demand during Phase 2 becomes 14 times larger than supply.

Under our optimistic scenario, aviation emissions return to 85% of 2019 levels this year and CORSIA demand surpasses 100mn credits in 2027. Supply is also bolstered by projects expected to be eligible under CORSIA-approved pilot methodologies that have a high and medium likelihood of receiving a corresponding adjustment – a further requirement of CORSIA credits (read more on this below). This means demand exceeds supply in 2030 (see Figure 2).

Without new projects generating credits, demand during Phase 2 in the optimistic scenario becomes seven times larger than supply.

Abatable’s projected supply includes projects existing in registries today expected to be eligible in line with the Integrity Council for the Voluntary Carbon Market’s Core Carbon Principles requirements, with a high likelihood of receiving a corresponding adjustment. Supply from Verra, Gold Standard and CAR is expected to be available from 2025.

The two scenarios are based on projected demand and supply in two different pathways for CORSIA’s market uptick as the scheme moves from its limited first phase into the fully mandatory Phase 2 from 2027.

To access Abatable’s full analysis, sign up for a demo of our market intelligence platform.

Corresponding adjustments, Letters of Authorisation and revocations – further potential for delay?

The scenarios modelled by Abatable are based on existing approved supply and supply expected to be approved. There are, however, additional factors that could result in supply delays under the scheme.

CORSIA by design interfaces with the Paris Agreement’s Article 6 mechanism, through which countries can trade emissions reductions between one another to meet their Paris Agreement emissions pledges, or Nationally Determined Contributions (NDCs).

When emission reductions or removals are traded between countries, ‘corresponding adjustments’ need to be made to each country’s carbon balance to that ensure progress towards their NDCs is accurate. To allow carbon credits – or climate mitigation units – to be traded between countries, Letters of Authorisation (LoAs) are required from a given carbon project’s host country stating that the unit can be transferred abroad with a corresponding adjustment.

Corresponding adjustments are also a requirement for CORSIA credits. A corresponding adjustment – ultimately a tool designed to prevent double counting – is applied to a credit that has been removed from the national registry of a host country and is therefore ‘uncounted’, so it can be counted in another party’s registry1.

COP28 saw delays for Article 6, which could also result in knock-on effects for CORSIA. While the details of the registry systems for Article 6 mechanisms are being discussed and developed, units can still be tracked on national registries. Projects receiving LoAs can list their projects on voluntary market registries, with these tagged as Article 6 compliant.

Biennial reports submitted by countries to the UN should confirm national accounting and the application of corresponding adjustments, and will be audited at the UN level.

The complex interlinkages between the CORSIA and Article 6 mechanisms throw up some complications, however, particularly around the issue of ‘revocations’ – i.e. if a host country specifies a credit null and void after it has been issued.

The biggest barrier to the approval of the remaining standards bodies that have applied for CORSIA centres on who assumes liability for the revocation of authorised credits.

ICAO’s Technical Advisory Body believes the standards or project proponents should assume greater liability, while the standards argue liability should lie with the revoking country. Revocations have been an area of contention at recent COP negotiations and, therefore, decisions at COP29 may guide further outcomes here. Delays could further impact CORSIA.

The market is responding to these developments. Prices for Intercontinental Exchange’s December 2024 Future contract rose to above $20 per tonne in March this year in response to the news that the Guyanese credits, with a floor price of $20 per tonne, may be the only CORSIA-eligible credits issued this year.

A proliferation of carbon insurance products has also been developed aiming to mitigate risks and encourage trading activity, with insurance companies looking to develop products to insure aspects of Article 6 to bring confidence to market participants. What shape these products might take will determine to what extent they can provide confidence to market participants and encourage liquidity.

Due to the uncertainty in the market, new commercial structures are also being developed. We are seeing projects with LoAs or other sellers of potential credits develop novel pricing structures that will allow for a discount if credits do not eventually gain or retroactively lose corresponding adjustments.

How are airlines responding?

Slowly. This could be due to the limited supply of CORSIA-eligible credits or a lack of education about the market. Airlines don’t tend to make long-sighted procurements to protect against price risks, typically only hedging two to three years ahead if prices are attractive. On a recent panel hosted by Intercontinental Exchange, a member of Lufthansa said that without consistent supply creating price signals, volatility is inevitable, and that the airline would not rush to procure credits for Phase 1.

In terms of the broader market, in some cases states have signed up to CORSIA without a thorough understanding of the scheme, leaving airlines to educate themselves. This will take time as airlines develop internal structures for the monitoring and procurement of credits and designate a budget to engage with the scheme.

How have standards reacted to the scheme and the delays?

The delay in the approval of the largest standard bodies – Verra, Gold Standard, and CAR – is due to the ICAO Technical Advisory Body’s view that they have failed to meet a range of eligibility criteria. Many of the ongoing issues are around how these standards will deal with the liability in the case of revocation of authorised credits by governments, with the Technical Advisory Body pushing more liability onto standards (and project proponents) than they believe to be reasonable.

When it comes to specific credit methodologies under the standards, until the Technical Advisory Body provides more information it is unclear which methodologies will or will not be approved. Eligibility for CORSIA is defined at the standard level, rather than by project type, however some specific methodologies will likely be excluded from the scheme. For CORSIA Phase 1, no methodologies have been excluded from the two standards approved so far, ACR and ART TREES.

Following the announcement of the delays, Gold Standard stated that there had been a lack of open dialogue with ICAO. It then published its clarifications and minor revisions when it re-submitted to the scheme.

ICAO previously published a document that outlined what it saw as gaps in the four conditionally approved standards. It is understood the Technical Advisory Board is keen to, as much as possible, approve standards as a whole and avoid fragmenting by methodology as they did in the pilot scheme. Our modelling assumes Verra, Gold Standard and CAR are all approved by 2025.

What’s next?

Now that Verra, Gold Standard and CAR have re-submitted, the Technical Advisory Board will reassess their applications and announce its decisions in September 2024. Should the standards fail this stage, applications won’t be reviewed or approved until 2025, significantly delaying new a supply source to the market beyond the scenarios we’ve modelled above.

To alleviate this, in addition to standards working towards approval, capacity-building processes to help countries develop the market infrastructure and governance to authorise credits with corresponding adjustments would alleviate another supply blockage.

Large CORSIA participants could invest upstream and originate projects, although this would require an in-depth understanding of the market and would take significant time to provide a stream of credits – as well as requiring the work to gain corresponding adjustments.

In terms of the next steps for CORSIA specifically, airlines don’t need to purchase credits to account for their emissions until after the conclusion of Phase 1 in January 2028, although some airlines may purchase and retire credits in advance as they should already be able to project an expected obligation quantity based on historical emissions.

The submission of final emissions reports and audits will be completed in 2027 to provide an overall indication of credits needed, and therefore credit retirements will inevitably increase once airlines have certainty of their obligations.

Whether there will be enough credits available to be retired in the years post-2027 will be impacted by the results of decisions by ICAO, Article 6 negotiators and governments and, more fundamentally, is dependent on new sources of supply entering the market.

Abatable has built CORSIA credit supply forecasting into its market intelligence product suite and is working to help airlines build CORSIA-compliant credit procurement strategies.

The modelling above represents a snapshot of our analysis. To find out more sign up for a demo of our market intelligence platform or get in touch at sales@abatable.com

In mid-February Abatable, in partnership with Gold Standard, convened government representatives, lawmakers and carbon project developers to discuss what the future looks like for CORSIA and how the Article 6 market can scale to support its growth. The resulting webinar is available to view here.

1 It is important to note that international aviation falls outside of the scope of the Paris Agreement and is not included in countries’ NDCs. Despite this corresponding adjustments are needed for CORSIA accounting and inventory purposes.